We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

The COVID-19 is Reshaping Supply Chains

As infection rates continue to rise around the world, economic growth is experiencing a sharp slowdown.In April, the IMF International Monetary Fund announced the "World Economic Outlook 2020", predicting that the global economy will shrink by 3% this year. This year and next two years, the global economic loss will reach 9 trillion US dollars.

According to this forecast data, the global economic contraction in 2020 will be the largest since the Great Depression in the 1930s. In contrast, the financial crisis caused the global economic contraction by 0.7% in 2009.

During the economic crisis, consumption is reduced, and the factory operating rate is correspondingly reduced, which means that local workers will be reduced wages or even be dismissed. If their income is affected, they will further reduce demand and consumption. The economy thus fell into a vicious circle. Possible currency devaluation will follow as well.

In view of the current situation, investors tend to be more cautious when entering into transactions, so the transaction amount will definitely decline. The value of assets may usher in decline. Activities will decrease. Whether it is a question of short-term investment sentiment or a ripple effect in other industries will depend on whether the epidemic can be controlled within a short period of time.

According to Economist Adam Slater from Oxford Economics, total world trade in goods and services could fall by 10%-15% in 2020, compared to a 10% decline in 2009 during the global financial crisis.

The sensitivity of goods trade to industrial output looks to have risen over time. Based on the relationship since 1980 and using our industrial output forecasts, we estimate goods trade may fall 8%-15% this year in different macroeconomic scenarios.

Risks to the estimates of trade decline look skewed to the downside. Trade falls relative to output tend to be larger in crisis periods that feature de-stocking, financial dislocations, and rising trade costs. So, the decline in total goods and services trade this year may be even worse than our central estimates.

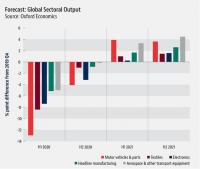

Referring to the five manufacturing industries, global output is expected to drop 13% for automotive, 8% for both textiles and electronics as well as 5% for headline manufacturing, and aerospace and other transport equipment, as compared with Q4 2019.

According to the global sectoral output forecast below, after a dramatic decline in H1 2020, all five sectors shown in below Figure will experience a recovery in H2 2020. While electronics may take more time to rebound, automotive and textiles are expected to see a positive percentage point difference from Q4 2019 by H1 2021.

Due to China ’s unique position in the global supply chain and China ’s sensitivity to the decline in global demand as a major exporter, the forecast shows that China ’s output decline this year is significantly greater than the global decline (as shown in the table below) It is not until 2022 that the industry will truly recover to 2019 levels. In the first half of 2020, compared with the fourth quarter of 2019, the output of the Chinese automotive industry will fall by 19%, while the output of the electronics industry will fall by 17%. In the first half of 2020, the output of the textile industry will decline by 14%, while the overall manufacturing and aviation industries will decline by 11% and 6%, respectively.

In China, the negative growth in industrial output of automobiles and electronic products may pose challenges to supply chain companies. Due to travel restrictions and quarantine requirements, companies There will be challenges in restoring production capacity. Logistics and transportation networks that supply upstream parts and components will also continue to be interrupted.

Due to business controls and production suspensions in countries around the world, companies in China that source raw materials and parts from overseas will face supply chain disruptions In addition, as some Chinese suppliers are forced to close or fail to recover enough capacity, many downstream companies in the global supply chain will be forced to find alternative suppliers. In terms of finding alternative suppliers that can meet specifications and quality requirements There may be difficulties. Downstream companies may not be able to fulfill their contractual commitments or resume sustainable operations

Not to mention if in the coming months, the COVID-19 focus moves to emerging markets, we may even face more challenges in ensuring the supply of certain commodities categories.

Professor Ba Shusong: Vice President of CSM China Society of Macroeconomics said that from the objective conditions, after the outbreak, many countries and regions began to take measures to block borders and reduce international flights. The interruption of people and logistics has seriously damaged the international trading system.

However, if we only consider the suspension of production and trade activities caused by the prevention and control of the pandemic, it will not have a sustained impact on globalization. It should be noted that due to limited international trade circulation, the original complete industrial chain and supply chain have become fragmented. Some enterprises that rely on multinational supply chains have faced periodic supply interruptions, and populism has risen in part. Accelerate the return of domestic manufacturing.

Short-term shocks are difficult to change long-term trends. From the experience including the Spanish flu, this new crown pandemic will be a short-term exogenous shock, even if there is a short-term economic recession, it will not lead to a global economic and financial crisis.

Indeed, lot companies will suffer significant losses due to COVID-19, however certain business and industry have seen increased demand or already agile enough to deal with the crisis by developing new products and / or services.

Over the past years, the world starts to realize the problems caused by excessive concentration and opaque supply chains. Especially after COVID-19 pandemic, it will inevitably lead to the reorganization of the global supply chain,

According to the tariff impact survey conducted by the American Chamber of Commerce in May 2019 on member companies, in response to the impact of tariffs, 35.3% of the respondents adopted “produce for China” strategy, 33.2% postponed and canceled investment decisions, And about 39.7% of the respondents are considering moving their manufacturing plants outside of China. The virus crisis may push close to the US companies based on tariff issues that already have intentions to move out to action.

US Secretary of State Michael Pompeo said before that the United States is working with India, Australia, Japan, New Zealand, South Korea and Vietnam to study how to "reorganize these supply chains to prevent similar things from happening again"

But does this mean a large-scale withdrawal from China?

Over the past two decades, China has become a huge and increasingly affluent consumer market, which explains why manufacturing investment continues to flow into China. China accounts for 35% of global manufacturing output. According to World Bank data, although China accounts for only 10% of global household consumption, it was the source of a 38% increase in global household consumption between 2010 and 2018.

As for China's manufacturing industry, the output value has already ranked first in the world. It would be difficult for any other emerging markets to undertake such capacity transfer in large numbers, and developed countries that are capable of it are not willing to or cannot do so in the short term.

In addition, the current pandemic has also exposed the fact that many manufacturing industries in Vietnam and Thailand actually rely on Chinese supply sources, which is also a complexity that multinational companies must consider in the global layout in the future.

This pandemic is not necessarily the end of globalization, but may be a new starting point.

Over the last thirty years, logistics has undergone a tremendous change. Now due to the current supply chain crisis, supply chain risk management has topped the agenda of many companies. Companies with thoughtful and comprehensive supply chain risk management processes are more likely to find sudden changes. The impact of the incident on its supply chain and product supply, thereby providing the company with an opportunity to assess how to best respond in a difficult environment.

In the long run, the digitization of the supply chain will gradually become a way for companies to formulate strategies for supply chain disruptions and gain business pressure resistance. It will be more critical and important than ever and will play a key role in defining strategy as we reimagine the global supply chains of tomorrow. In this context, big data analysis can help companies simplify the supplier selection process, and cloud computing is increasingly being used to promote and manage supplier relationships.

Unlike the other industries, COVID-19 pandemic has ushered in a turnaround in the vitamin, dietary supplement market. The sales of vitamin C and other health products, especially the immunity products in pharmacy have risen sharply. The increasing demands on certain immunity items have push the market up.

Now most of the factories in nutrition industry are able to reach their full capacity, however due to the pandemic, both manufacturers and customers are more cautious to entering into transactions.

Due to travel restrictions and quarantine requirements, logistics and transportation remain a challenge for companies.

Under this circumstance, to catch up with the new generation digital supply chains, Acerchem B.V has established Ingredients4U platform which will make the transaction more efficient, accurate and flexible, by providing a totally transparent supply chain to our customers. All the information about price, delivery, stock, manufacturers information, quality documents, etc. are openly shared in our website and will be updated based on the actual market.

You are welcome to join us: https://www.ingredients4u.com/

Ingredients4u Team